2011-2020 | FAO, OECD Future Agricultural Outlooks

Fri, 06/17/2011

A new report done by the OECD and the UN Food and Agriculture Organization (FAO) have produced a grim Agricultural Outlook for the next decade of food prices.

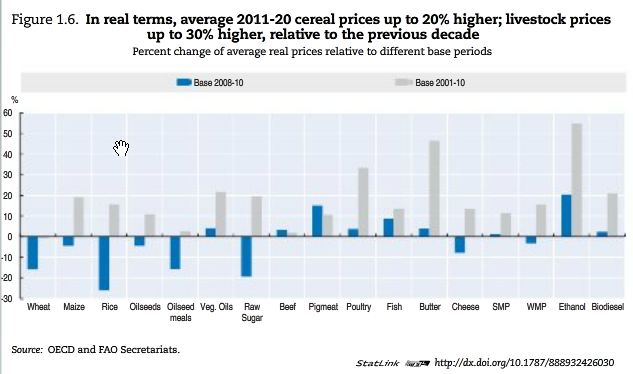

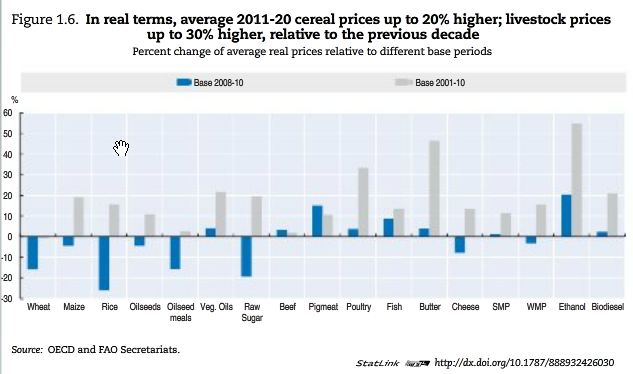

They expect that prices of cereals to raise by 20% and livestock to raise 30%. In the report, they conclude that changes in price volatility is due to:

- Global Weather & Climate Unpredictability - Until weather security improves, uncertainty in the global climate, along with natural disasters, is the most crucial factor currently affecting food price volatility.

- Supply & Demand - as global consumption and populations continue to rise, the price and overall stock has not grown rapidly enough to meet demands, especially in the case of course grains, therefore outpacing the growth of supply needed, while having little crutch to fall back on in reserves. Predicted demands of poor countries are expected to increase by 50%, making agriculture one of hot-button issues of the next decade.

- Energy Cost - The cost of production to get food from the field to the plate can be expensive as fuel and fertilizer costs, coupled with the biofuel feedstock demand, fluctuate, (and are projected to climb even higher).

- Resource Crunch - The amount of money needed to see a thriving agricultural market and the price that is actually paid is vastly unmet. Unless the speed of agricultural technology improves, the expansion of farms occurs across the globe, and limitations based on water usage and growing multiple crops per farm occurs, it seems we will continue to run into higher cost and not enough supply.

- Trade restrictions & Exchange Rates - Export and import restrictions are indelibly linked to higher cost of food as international markets move. Beyond that, commodity prices relative to one country is different for the next, therefore impacting food security and competitive pricing around the globe.

- Guesstimation - Food experts agree that the more futures markets in food price are speculated and the prices rise in the short term, there is no real evidence of how the food supply is truly affected, meaning that there is inconclusive evidence that price hikes really make sense in the long run.

As researchers do, they remain "cautiously optimistic" in seeing prices drop from their recent rise since August 2010, although they do believe them to decrease. The report is clear in their message, saying that agriculture productivity has to increase to meet the vast foreseeable demands and needs of the future.